5 Incentives for Texas EV Owners

You’ve invested in an electric vehicle. Are you getting the biggest bang for your buck out of the incentives and rebates that might be available? This guide will help you navigate your way to savings. As you look through the list, remember that you can combine federal, state, and local incentives!

Federal Tax Credits for EV Owners

The federal government offers a tax credit of up to $7,500 for qualified EV and hybrid vehicles. If you purchased a new one in or after 2023, you may qualify for the full amount. And as of January 1, 2024, buyers are able to transfer the federal EV tax credit to a qualified dealer at the point of sale, turning the credit into an immediate discount. You can even get a credit for a used vehicle purchased from a dealer in or after 2023, if the vehicle was $25,000 or less, for 30% of the purchased price up to $4,000. To learn more, check out this link or see additional details at IRS.gov.

State-Specific Rebates and Incentives

The Texas Emissions Reduction Program (TERP) makes a $2,500 rebate available for the purchase or lease of an electric or plug-in hybrid vehicle. This rebate applies retroactively to EVs and hybrids purchased on or since September 1, 2021. However, TERP only offers 2,000 rebates and they are offered on a first-come, first-served basis. More information on TERP and deadlines can be found at the Texas Commission on Environmental Quality website. Find out more about Rhythm discount offers.

Local Utility Incentives

Some utility companies in Texas offer rebates and discounts, including special rates like time-of-use and off-peak rates for EV charging. To learn which ones might be available in your area, review the list at the US Department of Energy page specific to Texas.

Environmental Benefits of EV Incentives

One of the major drivers (pun intended) for residents and commercial vehicle owners to buy an EV is well-known: the reduction in your personal greenhouse gas emissions and carbon footprint. EVs emit around 17-30% less carbon than gas or diesel cars, even when taking into consideration the source of electricity generation. When also using green electricity, EVs can reduce lifecycle emissions by nearly 90%, compared to combustion engine vehicles.

Financial Benefits of EV Incentives

There are also cost savings to an EV purchase. Even with higher upfront and insurance costs, some say that EVs can save drivers between $6,000 and $10,000 over the life of the car, with those numbers as high as $18,000. These savings come from lower fuel and maintenance costs, and can be especially visible during the first few years of ownership. .

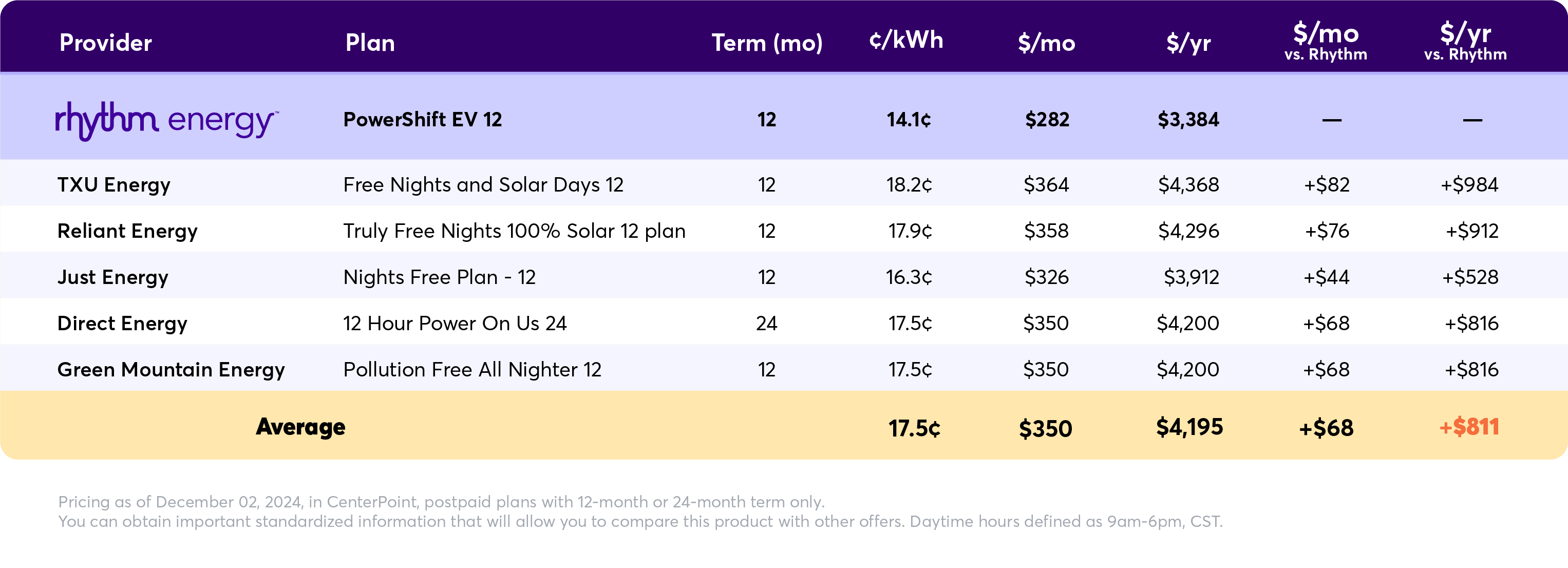

Rhythm Energy's PowerShift EV

Here at Rhythm Energy, we have the best EV plan in the industry. And it's, of course, backed by 100% renewable energy like wind and solar.

This plan is for EV owners who can be flexible with their charging schedule, with lower rates for charging overnight, when demand for electricity is lower. And the savings, well, they speak for themselves.

To learn more about these plans, and see which ones are available in your area, visit our EV vehicle plans page.

FAQs

What specific EV incentives are available in Texas?

Federal tax credits, the TERP rebate, and even some local utility incentives may be available to you, based on your location.

How can I apply for these incentives?

You need to apply for each incentive at the appropriate level: federal, state, or local.

How does owning an EV affect my electricity usage and costs?

An EV can dramatically reduce your overall costs, especially if you sign up for a plan like PowerShift through Rhythm Energy. You can even get charging credits through our Simply Drive program.

What is the long-term outlook for EV adoption in Texas?

According to the website EVadoption.com, EV sales are predicted to grow to reach approximately 29.5 of all new car sales in 2023.